Check Survivor Safety

MayRetire now allows you to visualize the financial impact of an early death, helping you ensure the surviving spouse’s retirement plan remains secure.

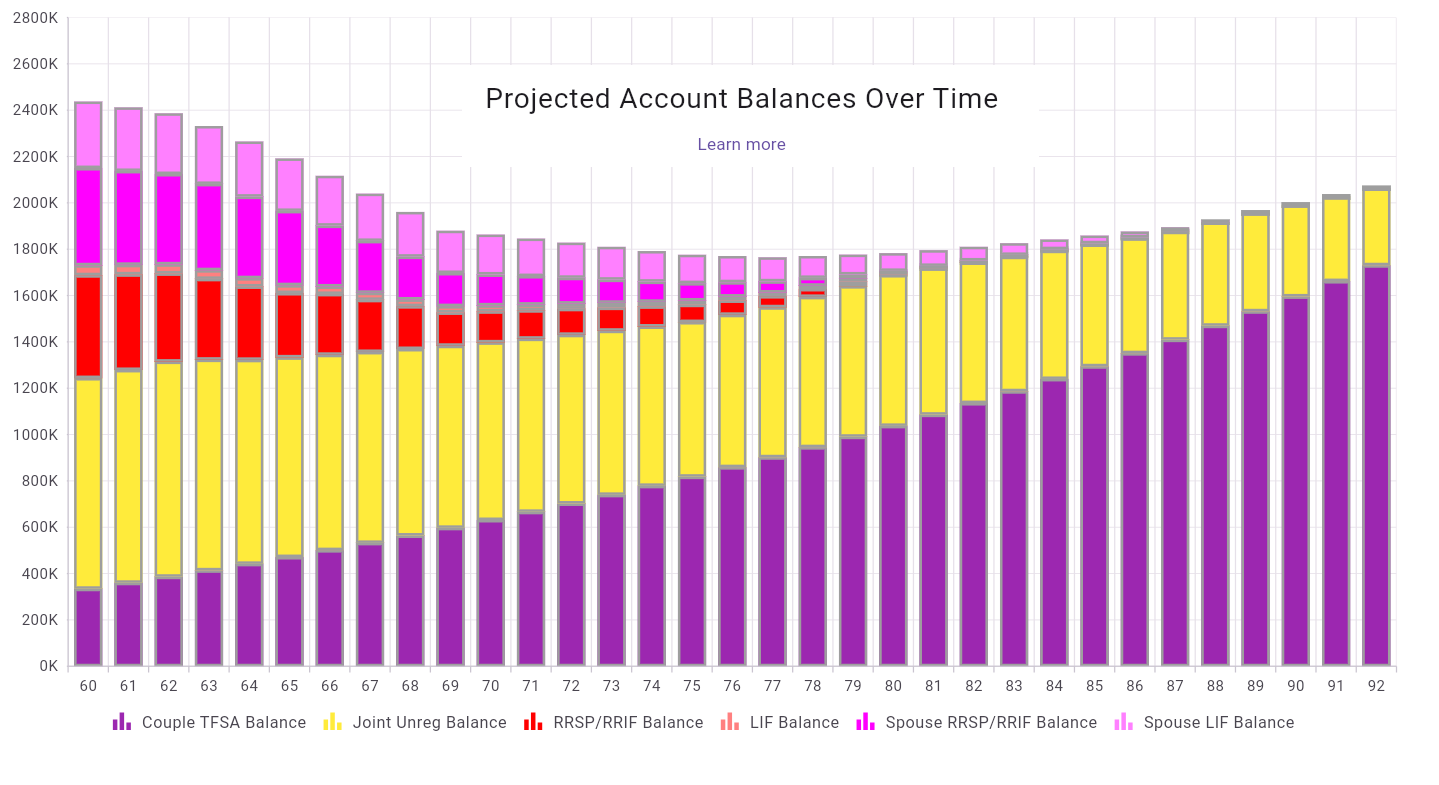

Whether you rely on RRSPs, TFSAs and government benefits or manage a complex mix of Corporate Accounts, Rentals, and Defined Benefit Pensions, MayRetire brings it all together into one clear, tax-efficient plan.

Minimal complexity. Maximum clarity.

A Canadian retiree's greatest fear is that they will run out of money. MayRetire cuts out the busywork, allowing you to plan the future—and see your future. You can retire with confidence when you see your cash flow plan laid out in clear fashion.

"Easily the best tool I've tried. As a software developer, I appreciate the single-page design—it's the right choice. Data entry for assets and income is simple, efficient, and surprisingly complete."

"Simple to use but feature-complete. I've maintained a complex Excel sheet for years, and MayRetire completely blows it out of the water."

"Finally, a tool that assumes you're smart enough to understand your own portfolio. It lets you focus on tweaking scenarios to see the impact immediately. Awesome."

"I've been using the platform for months and it's fantastic. I recently discovered the 'backtest' feature... wow! It adds a whole new layer of confidence."

"Loving the platform so far. It's clear a lot of hard work and thought has gone into building this for Canadians."

"Quickest and most straightforward tool I've used. Gives a great high-level look to see if you're on the right track before moving to a plan with a financial advisor."

We are constantly improving MayRetire based on feedback from the community.

MayRetire now allows you to visualize the financial impact of an early death, helping you ensure the surviving spouse’s retirement plan remains secure.

Dale Roberts uses MayRetire to model a comprehensive retirement strategy, demonstrating how to achieve a $110,000 annual retirement income. Read the full article here.

The Detailed Projections Table presents a wealth of data, but we know it can be cumbersome. Based on feedback, we added an option to show/hide specific column groups, allowing you to focus strictly on relevant data.

Many financial tools monetize your data by selling leads to wealth advisors. We don't. MayRetire is built on a Local-First Architecture.

Your financial inputs are stored in `localStorage` on your own device. We do not have a database of your net worth.

No Facebook Pixel. We don't share your portfolio size with ad networks.

Since you own the data, you can export your plan to JSON or CSV at any time for your own backups.

MayRetire started as a personal project. I was frustrated with the options for Canadian retirement planning: clunky government calculators, overly simple estimates, or complex tools that required hours of work before seeing even initial results.

I spent hours watching videos from leading Canadian planners and simply couldn't comprehend why even basic planning services start at $3,000–$4,000. When I attempted retirement planning at one of the big Canadian banks, it was a disappointment. When I asked which account I should withdraw from first to be tax-efficient, the answer was: "To answer that, you need to talk to your accountant."

I decided to build a better way. What began as a tool for our own family has evolved into a platform trusted by thousands of Canadians to make confident, data-backed decisions about their future.

Now, MayRetire is improving rapidly, driven almost entirely by the feedback and suggestions of our users. And this is just the beginning.

Join thousands of fellow Canadians taking control of their retirement data.